Nigeria’s Central Bank says 14 banks have successfully met new capital requirements introduced under the ongoing recapitalisation programme, a move aimed at strengthening the financial system and boosting investor confidence.

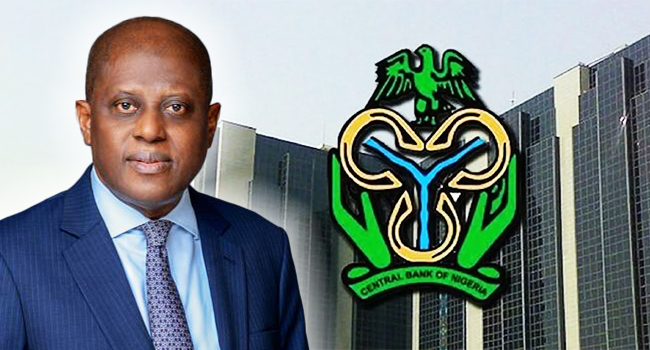

Governor Yemi Cardoso disclosed the progress on Tuesday while presenting the communiqué from the Monetary Policy Committee’s (MPC) 302nd meeting in Abuja.

The apex bank also announced a cut in the Monetary Policy Rate (MPR) from 27.5% to 27%, the first reduction in three years, as part of measures to ease credit conditions and support economic growth.

Banking sector reforms

Under the recapitalisation plan, international commercial banks are required to raise their minimum capital base to ₦500 billion, while national-level banks must meet ₦200 billion. Regional lenders face a ₦50 billion requirement, the same as merchant banks. Non-interest banks have lower thresholds of ₦20 billion (national) and ₦10 billion (regional).

The last major recapitalisation was in 2004, when the CBN increased the minimum capital requirement from ₦2 billion to ₦25 billion, triggering a wave of mergers that cut the number of banks from 89 to 25.

Cardoso said the MPC welcomed the “significant progress” in the current exercise and urged continued reforms to ensure stability.

Interest rate cut and liquidity moves

Alongside the rate cut, the CBN reduced the Cash Reserve Ratio (CRR) for commercial banks from 50% to 45%, introduced a 75% CRR on non-Treasury Single Account (TSA) public deposits, and kept liquidity ratios unchanged.

Cardoso said the decision was influenced by five consecutive months of disinflation and projections of further declines in inflation through the end of 2025. He added that Nigeria’s foreign reserves had climbed to $43.05 billion by 11 September, with import cover of 8.28 months.

Mixed reactions from industry

The Nigeria Employers’ Consultative Association (NECA) welcomed the policy shift, calling it a “timely intervention” amid easing inflation, which slowed to 20.12% in August from 21.88% in July. But it warned that businesses would only benefit if lower credit costs reached the real economy.

The Centre for the Promotion of Private Enterprise (CPPE) praised the easing of credit conditions, while the Association of Small Business Owners of Nigeria (ASBON) described the MPR cut as “positive but symbolic”, warning its impact may take time to filter through.

Analysts noted that while the relaxation offers relief, risks remain from insecurity and volatile global commodity prices.

Still, the CBN’s message was clear: with macroeconomic stability improving, policymakers now see room to prioritise growth without derailing the fight against inflation.