Nigeria’s Association of Mobile Money and Bank Agents (AMMBAN) has said Point-of-Sale operators are not legally required to register with the Corporate Affairs Commission (CAC), despite a government deadline targeting unregistered businesses.

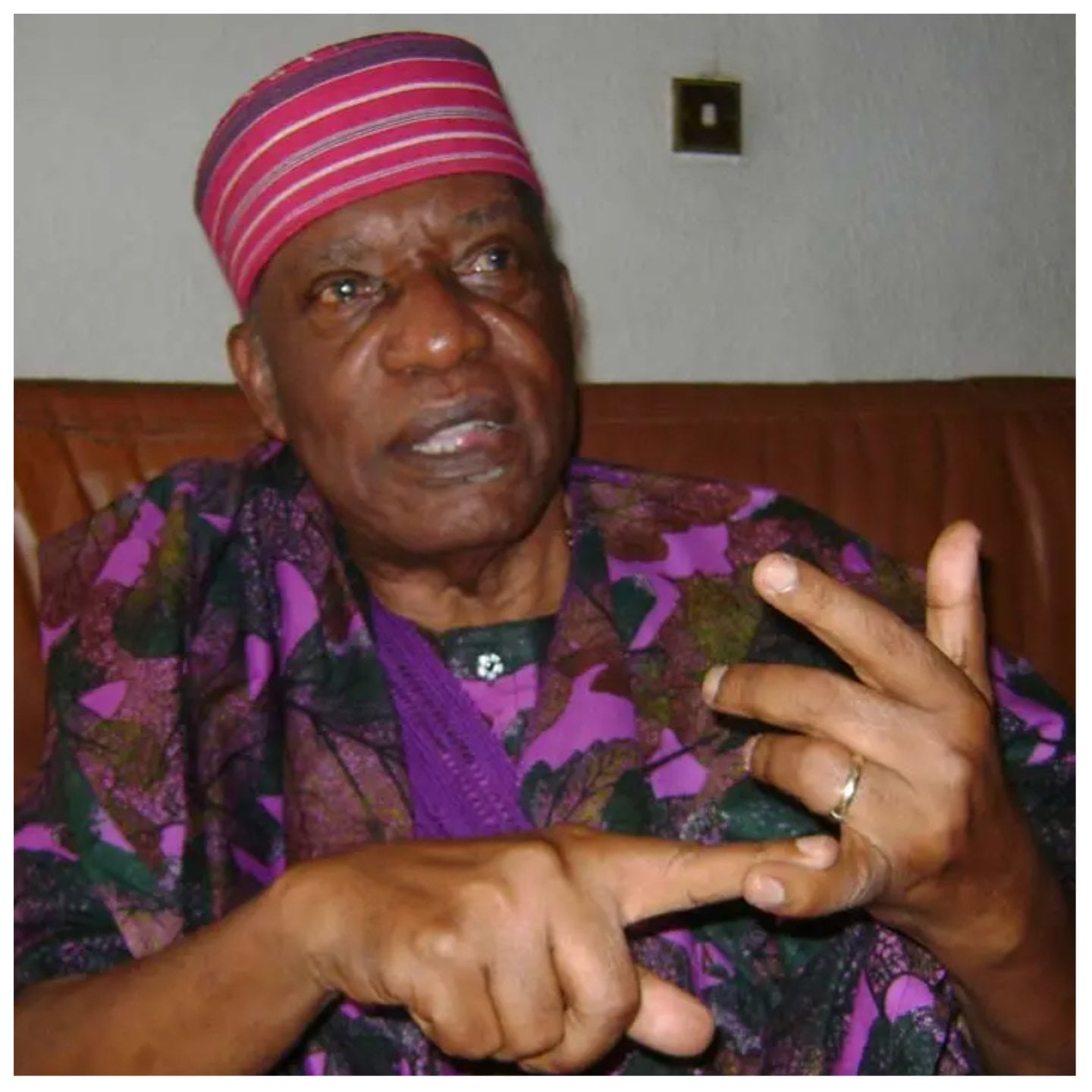

General Secretary of the association, Elegede Segun, told Daily Post that POS agents already undergo extensive verification before they are allowed to operate — and therefore should not be treated as illegal businesses.

He argued that existing identification layers, including Bank Verification Numbers, National Identification Numbers, active bank accounts and terminal IDs issued through the Nigeria Inter-Bank Settlement System (NIBSS), are sufficient safeguards for regulators and financial institutions.

“What is baffling is the issue with the CAC,” Segun said. “Why would you enforce business registration on POS operators? Company and Allied Matters Act clearly states that you can operate as an individual or as a non-entity. You cannot force anyone.”

According to him, the claim that there are “illegal POS operators” is misleading, as no terminal becomes active without authorization.

“Before a POS terminal works in Nigeria, the operator must obtain a terminal ID from NIBSS. This is not like buying a phone anywhere,” he added.

The CAC had earlier set January 2026 as the enforcement deadline for unregistered POS operators, warning that it would also sanction fintech companies enabling non-registered agents.

The commission maintains that formal registration helps improve accountability, strengthens consumer protection and enhances traceability across Nigeria’s fast-growing agency banking network.

AMMBAN, however, wants clarity — insisting the law already recognises individuals and partnerships operating without formal incorporation.

As the deadline approaches, the debate exposes growing tension between financial inclusion initiatives and regulatory tightening across the country’s digital payments ecosystem.