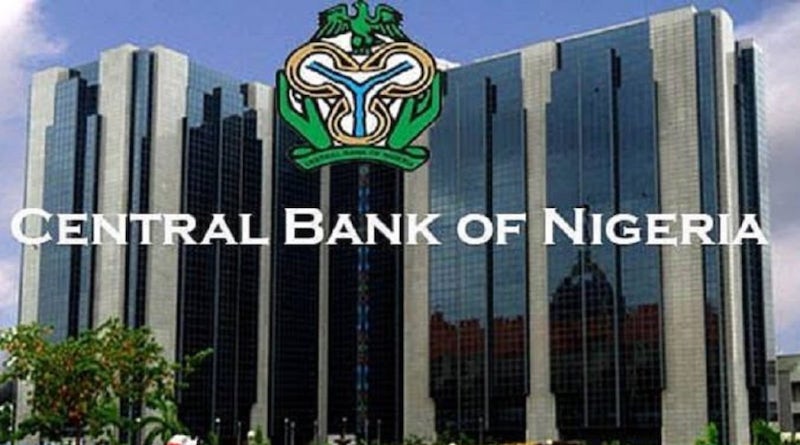

The Central Bank of Nigeria on Tuesday raised its benchmark lending rate to 16.5 per cent in a sustained push to control inflation and ease pressure on the naira.

Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), made this known at the end of the Monetary Policy Committee meeting in Abuja. The CBN said previous increases were beginning to yield results and there was need to keep tightening. It tightened by 100 basis points.

Mr Emefiele announced that the committee also retained the Cash Reserve Ratio (CRR) at 32.5 percent, and voted to retain the asymmetric corridor at +100 and -700 basis points around the MPR. The liquidity ratio was retained at 30 per cent.

Cash reserves ratio is the share of a bank’s total customer deposit that must be kept with the central bank in the form of liquid cash, while bank’s liquidity ratio is the proportion of deposits and other assets they must maintain to be able to meet short-term obligations.

Earlier in the year, the CBN had raised the cash reserve requirement (CRR) to a minimum of 32.5% in a bid to mop-up liquidity.

In October, Nigeria’s inflation rate hit a 17-year high of 21.09% amid skyrocketed food and petrol prices.

The CBN has equally continued to face the daunting task of reducing the currency in circulation, while curbing the rising cost of goods and services across the country.

As part of measures to control money supply, the apex bank in October announced that it had redesigned all major naira notes and will by December 2022 start circulating them.

The naira appreciated to N775 per dollar at the parallel section of the foreign exchange market on Monday, gaining N15 or 1.9 percent compared to the N790 it traded last Friday. At the Investors and Exporters window, the naira appreciated against the dollar, exchanging at N445.38.

The central bank hopes raising rates will reduce money supply in the economy and rein in inflation, but some analysts also said that the move also faces the risk of slowing economic growth.

A higher interest rate will raise the cost of borrowing for businesses, and may make goods and services even more expensive for the consumers as the yuletide season approaches.

On Tuesday, Mr Emefiele said global inflationary pressure was quite high and there was a need to moderate the increasing inflationary concerns. He added that the MPC did not consider the need to loosen the rates due to the prevailing circumstances although he said there were indications previous decisions to hold increase rates were beginning to yield results.